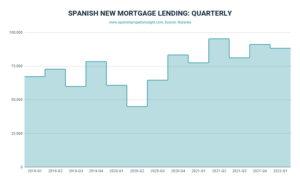

Mortgage Lending:

Mortgage Lending: Regional

Rising Interest Rates:

The Foreign Buyers:

Barcelona Property Market:

Barcelona is a well-known city with a wonderful location on the Mediterranean coast, presiding over a prosperous and fertile getaway region between France and Spain.

The remarkable scenery and culture of the Catalan city draw about 10 million tourists annually, placing it among the top 20 tourist destinations in the world.

Barcelona has drawn a lot of second home buyers and investors over the past few decades, as well as a growing number of expats who are choosing to make the city their permanent home.

The city provides numerous offers such as economic and lifestyle benefits, including first-rate healthcare and education.

Sales Information:

The Barcelona real estate market is robust right now, with sales exceeding those of 2018 , with foreign demand rebounding following the epidemic. This can be seen in the graph above

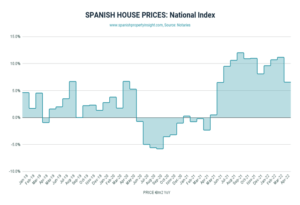

Price Information:

Market Observation: Conclusion